# ETF Wrap: Mortal combat? Nah, just inflation forecasts

Table of Contents

“#

ETF Wrap: Mortal combat? Nah, just inflation forecasts

”

Also, pot is hot. And, does it matter when you trade?

What just happened?

You know that thing they do on soap operas? Everyone’s greatest and most-frequently professed wish is “getting back to normal” now that the trial is over. The evil stepmother is vanquished. The long-lost, third husband is persuaded to go away. But it never happens, because as soon as that’s taken care of, another plot twist always emerges.

Granted, if you are reading “ETF Wrap” you may not be bingeing episodes of “General Hospital.” But you get the idea. Many of us still are processing the shock and awe of last spring’s coronavirus crisis and market meltdown, not to mention the unsettling ripples from November’s elections.

How, then, do we think about ongoing predictions of “normalization?” An investing community that hasn’t seen rates or inflation go up for more than a handful of months in over a decade might be forgiven for being somewhat skeptical that this time it’s for real.

Industrials

XLI,

and materials

XLB,

sector ETFs have gained roughly 1.5% in the year to date, while technology

XLK,

has jumped nearly 5% and communication services

XLC,

has climbed 7.6%, a sign of the continuation of the work-from-home trade. Meanwhile, community bank ETFs popped late last week on expectations of reflation, then slid again the next day. The 10-year U.S. Treasury note

TMUBMUSD10Y,

yield was cruising toward the key 1.20% mark, until the January CPI print missed expectations, then slipped nearly 3 basis points.

ETF Wrap will take a break next week, and see you back here on February 25 to consider inflation, reflation, normalization, and much more. Happy (hopefully non-virus-y) Valentine’s Day!

IVOL, You-VOL, We all VOL?

As investors start to jockey for inflation positioning, one ETF is grabbing attention.

The Quadratic Interest Rate Volatility and Inflation

IVOL,

ETF has picked up $347 million in the 12 months ending January 29, 2021, according to a recent analysis from CFRA. That lags some of the inflows to the bigger inflation-protection funds, like the $1.13 billion into iShares’ TIPS Bond ETF

TIP,

even as IVOL has vastly outperformed many of its peers.

IVOL lets investors hedge against fixed-income volatility, while also offering a hedge against stock-market shocks and inflation with exposure to Treasurys, rather than corporate debt.

As Nancy Davis, IVOL’s founder, has told MarketWatch in the past, the ETF is intended to “hedge against corrections in equity and real estate as the prices of equities and properties tend to fall during times of increased fixed-income volatility.”

CFRA’s analysis of the 12 months ending in January show IVOL had a total return of 15.6%, while the best-performing vanilla TIPS fund, the SPDR Portfolio TIPS ETF,

SPIP,

gained 9.7%.

That’s in large part because IVOL sailed through the coronavirus crisis volatility: as CFRA notes, “a more active approach to managing inflation proved fruitful for IVOL.”

It’s worth noting that a sizable chunk of the actively managed ETF universe is bond funds, as investors seem to look for, and find, more expertise in that asset class than in stocks.

Exchange-traded sundries

-

How’s “Infrastructure Year” going? As ETF Wrap noted a few weeks ago, 2021 kicked off with a friendly bet between two deans of the ETF world. What’s the best ETF to ride a Blue Wave of stimulative spending? ETF Trends’ Dave Nadig suggested the FlexShares STOXX Global Broad Infrastructure Index Fund

NFRA,

+0.20% ,

while CFRA’s Todd Rosenbluth likes Global X U.S. Infrastructure Development ETF

PAVE,

+0.36% .

Admittedly, it’s early, but PAVE is up about 5.1% for the year to date, while NFRA has eked out a 2.1% gain.

Is there an ETF for that?

Videogaming has come a long way since the children of the 1980s played Pac-Man in arcades and the two-dimensional, yet, oh-so-addictive, Tetris moved into our living rooms the following decade. It’s come so far, in fact, that it was the hottest meme of 2021 just a few weeks into the year.

But gaming is also a serious business, with revenues of approximately $175 billion in 2020, according to an industry estimate, a broad reach, and several pioneering business-model restructurings.

There is, of course, an ETF for that — and this one has no exposure at all to GameStop Corp.

GME,

The VanEck Vectors Video Gaming & eSports ETF

ESPO,

is a focused fund that aims for industry pure plays, said John Patrick Lee, VanEck product manager. Only about one-third of its portfolio is U.S.-based, in keeping with a global industry, and there’s not a lot of overlap with the S&P 500

SPX,

so it offers diversification. The fund charges 55 basis points, and is up 14.6% in the year to date — and has nearly doubled in value over the past six months.

Lee doesn’t so much talk his book as live his passion. He’s an avid gamer who believes in the business case for the industry. The stay-at-home economy helped ESPO last year, he acknowledges, but the industry has “structural, long term growth” at its back, he told MarketWatch.

Some of those long-term trends include the continuing “cord-cutting” that’s reshaping the media and entertainment landscape, shifting consumer preferences toward interactivity, a rising younger generation in some emerging economies, and better technology that allows for richer experiences for consumers — and more opportunities for producers to pick up revenue.

“There’s a long runway,” Lee said.

The one drawback? These very growth-y stocks may pause before going through another big spurt again. After record revenues, “there will be a pullback at some point,” Lee said.

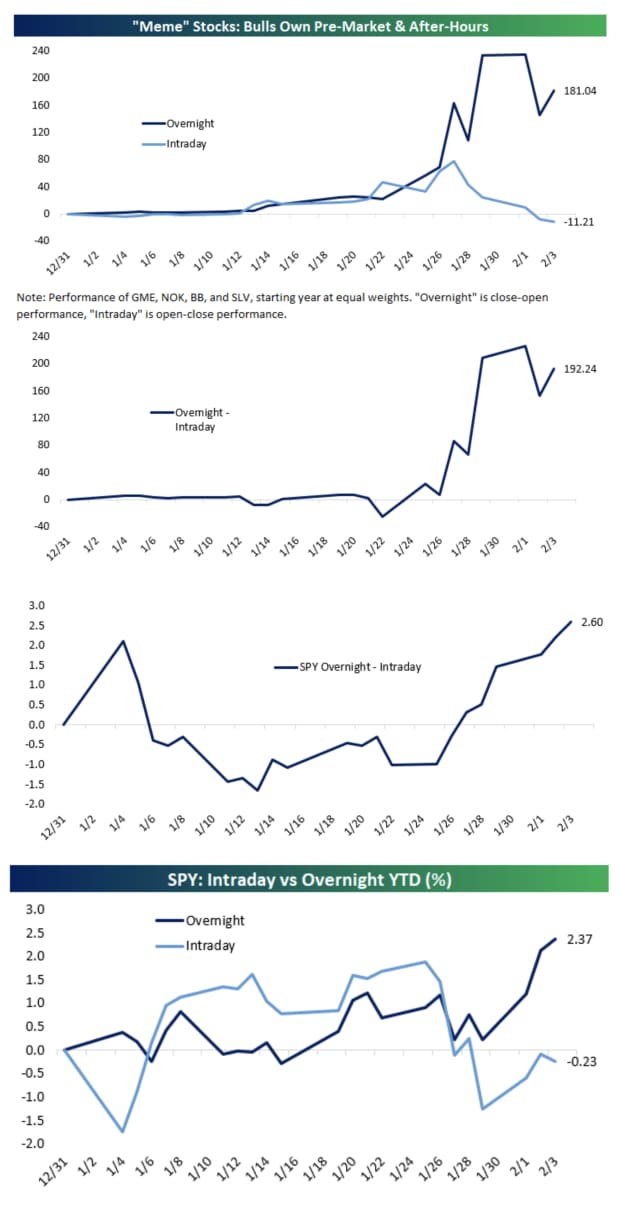

Visual of the week

There’s been a lot of chatter recently about trading patterns throughout the course of the day. The charts below, from Bespoke Investment Group, show that investors have been reaping better returns by buying at the close and selling at the next day’s open, versus buying the open every morning and selling at the close.

Weekly rap

| Top 5 gainers of the past week | |

| Global X Cannabis ETFPOTX | 30.8% |

|

Cannabis ETF THCX, |

26.9% |

| Amplify Transformational Data Sharing ETFBLOK | 24.7% |

|

ETFMG Alternative Harvest ETF MJ, |

24% |

|

Amplify Seymour Cannabis ETF CNBS, |

21.5% |

| Source: FactSet, through close of trading Wednesday, February 10, excluding ETNs and leveraged products | |

| Top 5 losers of the past week | |

|

Simplify Volt RoboCar Disruption and Tech ETF VCAR, |

-1.4% |

|

Global X MLP ETF MLPA, |

-1.3% |

|

WisdomTree Bloomberg US Dollar Bullish Fund USDU, |

-1.1% |

|

VanEck Vectors Egypt Index ETF EGPT, |

-1.0% |

|

Franklin FTSE South Korea ETF FLKR, |

-1.0% |

| Source: FactSet, through close of trading Wednesday, February 10, excluding ETNs and leveraged products | |

| Top 5 biggest inflows of the past week | |

|

Vanguard S&P 500 ETF VOO, |

$9.27 billion |

|

iShares Core S&P 500 ETF IVV, |

$6.73 billion |

|

SPDR S&P 500 Trust SPY, |

$3.54 billion |

|

Invesco QQQ Trust QQQ, |

$1.89 billion |

|

iShares Russell 2000 ETF IWM, |

$1.87 billion |

| Source: FactSet, through close of trading Wednesday, February 10, excluding ETNs and leveraged products | |

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.

By

Andrea Riquier

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.