#In One Chart: Stimulus that saved markets from collapse in 2020 now may be a key risk, warns Putnam Investments

Table of Contents

“#In One Chart: Stimulus that saved markets from collapse in 2020 now may be a key risk, warns Putnam Investments”

Financial markets avoided collapse last year when the coronavirus first cut a deadly path across the globe, largely because the U.S. and other developed nations rolled out trillions of dollars’ worth of pandemic stimulus.

The quick deployment of fiscal and monetary aid helped keep global economies from sinking into their worst recession since World War II.

From Putnam’s standpoint, a key risk in 2021 is a further “melt up” in risk assets. “It would be driven in part by the very same policy stimulus that has helped protect the global economy from collapse,” Putnam’s Jason Vaillancourt, co-head of global asset allocation, wrote in a co-authored first-quarter outlook distributed Monday. “Nobody rings a bell at the top.”

The S&P 500 index

SPX,

and technology-heavy Nasdaq Composite Index

COMP,

closed out Monday at record highs, even as the Dow Jones Industrial Average

DJIA,

extended its losing streak to a third straight session.

After the closing bell, Janet Yellen was confirmed as the first female U.S. Treasury secretary in history, roughly a week after she urged lawmakers to “act big” now to save the economy and worry about the debt later.

See: Janet Yellen wins Senate confirmation as Treasury secretary

Yellen, formerly a Federal Reserve chair during the recovery phase of the global financial crisis, has been a well-known voice on Capitol Hill. That could be helpful in drawing support from both sides of the political aisle as President Joe Biden fights for an additional $1.9 trillion pandemic fiscal spending package and his coming infrastructure bill.

The call for additional aid for U.S. households, businesses and cities hard-hit by the pandemic comes as investors around the globe continue to hunt for any additional upside that might be squeezed out of financial markets, following more than a decade of low rates and easy-money policies and a growing U.S. budget deficit.

Still, Vaillancourt’s team at Putnam sees how U.S. stocks “could potentially rip higher,” even though there already are showing “strong parallels with those heady dot-com days” that bear watching, including multibillion-dollar valuations for companies with “little to show for revenue,” insiders selling equity and the rise of special-purpose acquisition companies, or SPACS, that have raised large sums through initial public offerings.

Read: A surge in options trading is pushing around the stock market — and bringing back memories of the dot-com bubble

Why? “Two key lessons of the tech bubble were that some of the best price gains come late in the game, and that financial asset froth can persist longer than you expect,” Vaillancourt wrote.

There is also the need for investors to earn a return.

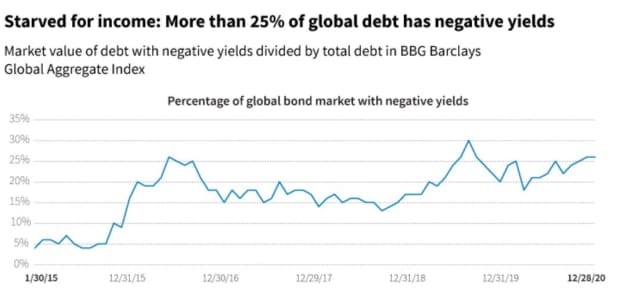

“In a world starved for nominal yield, large and growing pockets of savings still need to find a home,” the team wrote. “Capital will gravitate toward any asset that provides income.”

While not currently at all-time highs, there still was more than a quarter of the world’s debt at negative yields at year-end.

More than 25% of global debt has negative yields

Bloomberg Index Services Limited

By

Joy Wiltermuth

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.