U.S. stocks are rallying hard on Friday thanks to suggestions the Federal Reserve is contemplating shifting back to smaller interest-rate hikes after the November meeting, according a report in the Wall Street Journal claiming and comments by San Francisco Fed president Mary Daly.

But the fact that $2 trillion in U.S. equity options linked to stocks, indexes and exchange-traded funds are expiring — or have already expired — on Friday is also helping to influence trading on what’s shaping up to be the best week for the S&P 500 index since at least July.

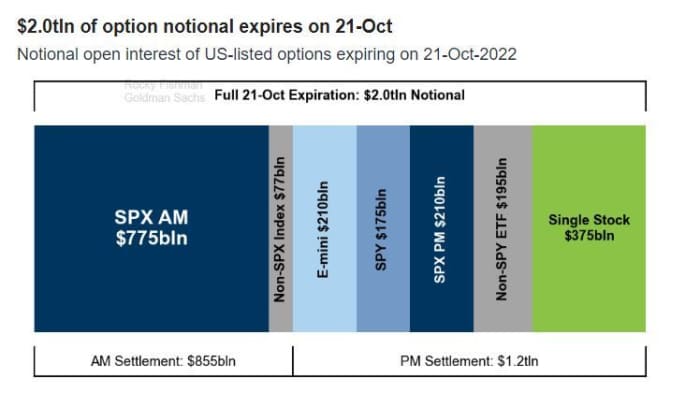

Here’s a breakdown of the options that are expiring, according to Rocky Fishman, the head of index volatility research at Goldman.

Options with a notional value of $855 billion expired Friday morning. But another $1.2 trillion notional will expire when the market closes.

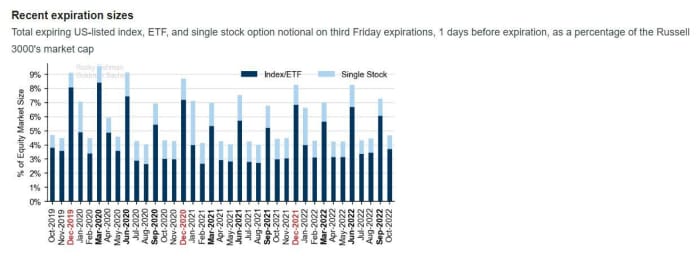

As Fishman and his team pointed out in a note to clients, options on individual stocks have shrunk has a share of total notional value outstanding.

Instead, investors have been buying more options linked to equity indexes and exchange-traded funds like the SPDR S&P 500 ETF Trust

SPY,

+2.15%.

With so much open interest around S&P 500 options with a strike price of 3,700 equity traders will be watching to see how big dealers hedge this risk, said Steve Sosnick, chief strategist at Interactive Brokers.

Given the sharp move higher in stocks on Friday, it’s possible that dealers contributed to the move as they bought stocks in anticipation of a spate of calls expiring in the money.

Dealers will have less risk to hedge this month than they did last month, as the notional value of options expiring on Friday amounted to less than 5% of the Russell 3000’s market capitalization, compared with more than 7% last month.

The S&P 500

SPX,

+2.10%

was up 2% at 3,737 in recent trade. The Dow Jones Industrial Average

DJIA,

+2.20%

was up 621 points, or 2.1%, at 30,950. The Nasdaq Composite

COMP,

-1.21%

was up 1.7% at 10,799.

Markets Live Blog: Dow up nearly 600 points as traders ponder potential Fed slowdown in rate rises