#ETF Wrap: ‘Green’ ETFs are minting some green as the energy crisis sparks a boomlet in alternatives

Table of Contents

“#ETF Wrap: ‘Green’ ETFs are minting some green as the energy crisis sparks a boomlet in alternatives”

An ETF for humankind? There’s a fund for that too

Happy Thursday: It is even happier for folks investing in alternative energy exchange-traded funds this week. That category of investment funds is starting to gain serious traction higher as an energy crunch leads to spikes in prices of everything from natural gas

NG00,

to heating

HO00,

and crude oil

CL.1,

We’ll take a look at some of the best performers.

And sign up here for ETF Wrap.

Also, sign up for a brand new MarketWatch newsletter on crypto launching next month. Use this link to subscribe to “Distributed Ledger,” where every week we highlight the most timely news in the crypto and blockchain industry, from developments in digital-asset companies, exchanges, funds and ventures, as well as important sector research and data. And of course, we’ll keep you up to speed on price performance in all the major crypto.

MarketWatch and Barron’s also is gathering the most influential figures in crypto to help identify the opportunities and risks that lie ahead in digital assets on Oct. 27 and Nov. 3. Sign up now!

The good and…

| Top 5 gainers of the past week | %Performance |

|

North Shore Global Uranium Mining ETF URNM, |

15.6 |

|

Global X Uranium ETF URA, |

14.4 |

|

Invesco Solar ETF TAN, |

10.5 |

|

ALPS Clean Energy ETF ACES, |

8.0 |

|

KraneShares CSI China Internet ETF KWEB, |

7.1 |

| Source: FactSet, through Oct. 13, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

…the bad

| Top 5 decliners of the past week | %Performance |

|

AdvisorShares Pure US Cannabis ETF MSOS, |

-3.1 |

|

Communication Services Select Sector SPDR Fund XLC, |

-2.5 |

|

ETFMG Prime Mobile Payments ETF IPAY, |

-2.1 |

|

Vanguard Communication Services ETF VOX, |

-2.0 |

|

Fidelity MSCI Communication Services Index ETF FCOM, |

-2.0 |

| Source: FactSet |

Clean in the green

Clean energy ETFs and other alternative fuel funds are on a mini tear, with at least five of the top 10 funds that ETF Wrap tracks via its screen underpinned by renewable assets.

Invesco Solar ETF, which comprises 46 solar-related companies, including the biggest holdings SolarEdge Technologies Inc.

SEDG,

and Enphase Energy Inc.

ENPH,

has gained over 10%, so far this week, which is handily outperforming the Energy Select Sector SPDR ETF

XLE,

up 0.3% so far this week. TAN, referencing the Invesco funds ticker symbol, has an expense ratio of 0.69%, which means that the fund will cost $6.90 annually for every $1,000 invested. (The much larger XLE has a expense ratio of 0.12% and has $25 billion in assets, versus TAN’s nearly $3 billion.)

Other green funds are also getting some shine.

Also in the Invesco suite, WilderHill Clean Energy

PBW,

which tracks some 70 “clean energy” companies, including Tesla Inc.

TSLA,

was up 6.3% thus far this week.

The iShares Global Clean Energy ETF

ICLN,

is up 6.8% on the week and ALPS Clean Energy ETF

ACES,

was up sizably too (table attached). We’ve already noted that uranium funds are exploding higher here and here, so we’ll leave it at that.

It is worth nothing that these funds are holding year-to-date losses, of at least 11%, though they are up over the 12-month period.

Hope that the Biden administration can finally push through an infrastructure spending bill is, perhaps, underpinning some of the newfound enthusiasm for clean energy ETFs. However, much of Biden’s economic initiatives, including infrastructure, are stalled in Congress because of divisions within the Democratic Party about spending, according to reports.

The crunch for energy that has caused a surge in fossil fuels is prompting a hunt for alternatives. Natural gas futures were trading around a seven-year high last week and U.S. oil futures for oil are near their highest level since 2014.

ProShares Ultra Bloomberg Natural Gas

BOIL,

which offers exposure to the hot commodity is up over 270% year-to-date and nearly 100% over the past 12 months.

BlackRock’s new ETF

As all eyes are on 10-year Treasury yields

TMUBMUSD10Y,

and the potential for the Federal Reserve to announce the start of tapering of its monthly asset purchases, BlackRock is rolling a new bond fund.

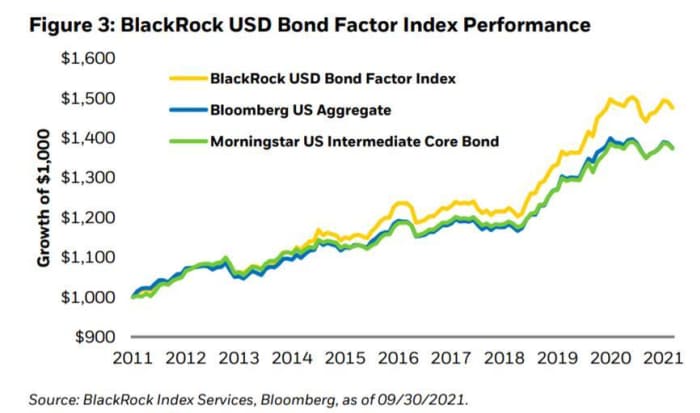

The iShares USD Bond Factor ETF tracks the BlackRock USD Bond Factor Index, and picks bonds that are underpriced relative to peers and exhibit lower probabilities of default, “using the quality and value stylefactors alongside macro factors.” For clarity, “factor” investing is built according to specific, predetermined characteristics of an asset such as value, growth, large-capitalization, or small-capitalization, to name a few.

Read:What is factor investing?

The fund, adding to the suite of such fixed-income offerings from BlackRock, carries a 0.18% expense ratio and the fund provider boasts that that is lower than 86% of mutual funds and ETFs in the Morningstar Core Bond category.

The underlying index has outperformed the Bloomberg US Aggregate bond and the Morningstar US Intermediate Core Bond indexes over the past six years or so.

via BlackRock

But as they say in investing, past performance is no guarantee of future success, especially amid fears of an inflationary world in which bonds are expected to go pear shaped, with yields rising and prices skidding.

That said even with a sizable move higher in the 10-year toward 2%, analysts would deem bonds to be at historically low yields.

“Historically low yields heighten the importance of broadening potential sources of fixed income returns,” wrote Karen Schenone, head of iShares U.S. fixed-income strategy within BlackRock’s Global Fixed Income Group, in a statement.

Is there an ETF for that

Humankind U.S. Stock ETF

HKND,

is touting its road to $100 million after being launched back in February on the Intercontinental Exchange

ICE,

-owned NYSE’s Arca platform. The passively managed fund carries a razor-thin expense ratio of 0.11%.

Humankind Investment’s says it uses a proprietary Humankind US Equity Index that tracks the top 1,000 US companies that “promote healthier, safer, more equitable and longer lives.”

Notionally, the concepts may sound very hokey, but the inflows into the ETF do speak to the stunning growth and adoption of investments by folks aiming to match their returns with their values and beliefs.

The growth in environmental, social, and governance, however, isn’t without some skepticism. Earlier this week, the Securities and Exchange Commission recently said that it was looking closely at advisory firms that advertise investment strategies focused on environmental, social, and corporate-governance commitments.

“In a nutshell, I think across all advisor types and as well as looking at registered investment company investments, we’ll be looking at compliance programs, portfolio management, and marketing and advertising,” said Kristin Snyder, deputy director of the SEC’s Division of Examinations at an annual SEC Speaks conference.

For its part, Humankind founder James Katz wrote that “our fresh, quantitative approach to measuring human impact seems to be resonating with investors looking for a differentiated model within a sustainable fund landscape that’s often inauthentic and a mild repackaging of mainstream products.”

Visual of the day

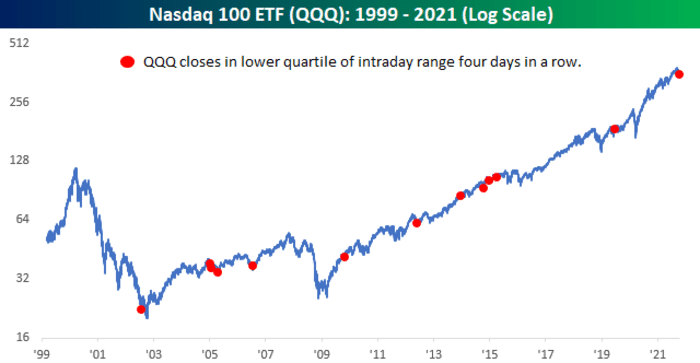

What happens when the QQQs, also known as the Invesco QQQ Trust Series I

QQQ,

ends in its lowest quartile for four straight sessions?

The folks at Bespoke Investment Group said that the QQQs did just that on Tuesday, tying the second-longest streak in the history of the ETF. A dubious feat that the SPY, or SPDR S&P 500 ETF Trust

SPY,

had been on the precipice of notching until paring its losses on Tuesday.

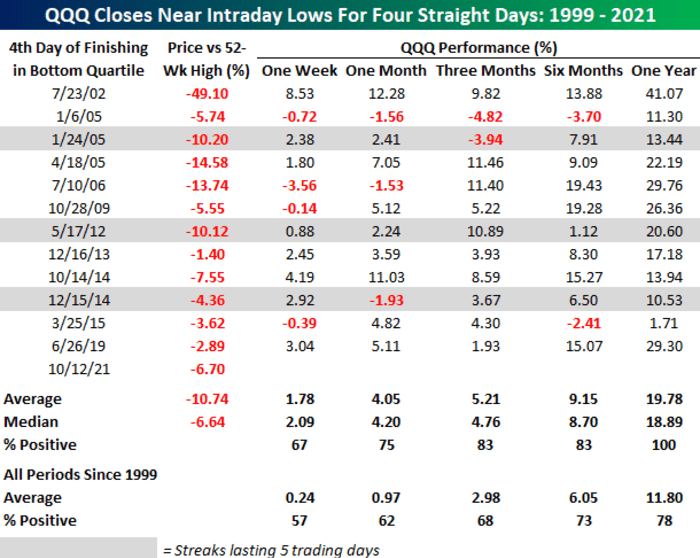

In any case, despite the bearish-sound record, the QQQs have tended to perform very well after such downbeat streaks, according to Bespoke.

Bespoke Investment Group

“One week later, QQQ’s median gain was 2.09% with positive returns two-thirds of the time. That compares to a gain of just 0.24% for all periods since 1999. For the one, three, six, and twelve-month periods, returns were similarly strong.”

On Tuesday, the Dow Jones Industrial Average

DJIA,

the S&P 500

SPX,

and the Nasdaq Composite

COMP,

indexes booked a third straight decline but were seemingly on the mend, at last check, Thursday.

Check out the attached table:

Bespoke Investment Group

Good ETF reads

- Cathie Wood’s ARK Will Give Its Name to a New ETF for Bitcoin Futures (Barron’s)

- Bitcoin ETF Approval May Actually Disappoint the Bulls (Bloomberg)

- A major crypto hedge-fund manager expects bitcoin to tumble once the SEC greenlights a bitcoin-backed ETF — here’s why (MarketWatch/Barron’s)

—That’s a wrap

By

Mark DeCambre

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.