#Earnings Watch: Third-quarter earnings were fantastic — until you peek below the surface

Table of Contents

“#Earnings Watch: Third-quarter earnings were fantastic — until you peek below the surface”

An analysis of the financial strength of travel-related companies finds things are not nearly as good as they seem

The third-quarter earnings season that’s currently winding down has seen S&P 500 companies generate overall per-share earnings growth of more than 27% and sales growth of more than 15%, numbers that suggest a robust recovery from 2020’s pandemic lows.

But the high growth rates, coming off what was for many companies a very low base, are masking underlying problems that do not bode well for the future. An analysis of the underlying strength of companies in one economically sensitive sector, that of travel and leisure, highlights the trend.

“The largest travel and leisure public companies are still on a knife’s edge,” said James Gellert, CEO of RapidRatings, a company that assesses the finances of private and public companies.

“For these companies, much of the pain has lasted over a year now, driven largely by empty properties, unsold tickets, continued confusion around lockdowns and quarantine policies, and an optimism that has yet to fully meet reality.”

It’s not just the travel sector that is feeling the pain. Many industries are struggling with inflationary pressures, supply-chain hassles, border closures and quarantine measures, including autos and retail, both of which saw high changes in cash to current liabilities from 2019 to end-2020.

“People need to monitor all industries, and companies within them, carefully to observe whether the “new” liquidity gained over the past 4-5 quarters can sustain companies or just prop them up for a while longer,” said Gellert.

See now: Hopes for a business-travel boost are dwindling for U.S. airlines as September bump fails to materialize

Deep dive

RapidRatings analyzes a company’s financials and assigns it a financial-health rating, or FHR, and core health score, or CHS. The former is a measure of short-term probability of default and the latter evaluates efficiencies in a business over a two- to three-year perspective.

“‘The largest travel and leisure public companies are still on a knife’s edge. For these companies, much of the pain has lasted over a year now, driven largely by empty properties, unsold tickets, continued confusion around lockdowns and quarantine policies, and an optimism that has yet to fully meet reality.’”

— James Gellert, CEO, RapidRatings

Both produce a number on a scale of 1 to 100, that is grouped in categories based on risk, as a means to help a potential business partner, vendor or counterparty determine how a company will perform over time. Only financial data is analyzed, and not share price or other market data that would include investor sentiment.

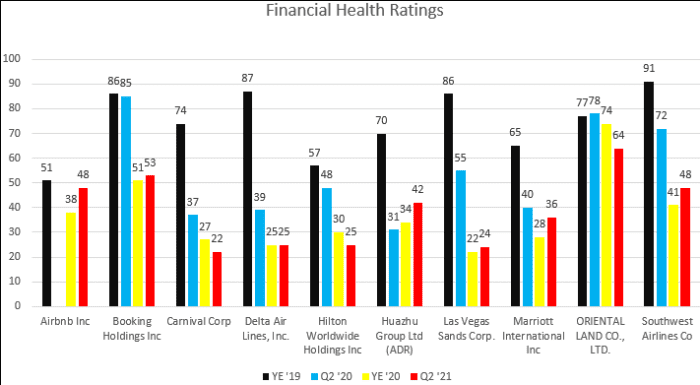

As the chart below illustrates, a sample of companies in the travel and leisure sector had mostly strong FHRs at the end of 2019, before the start of the outbreak. Southwest Airlines Co.

LUV,

led the pack with an FHR of 91, but that has fallen sharply to 48 at the end of the second quarter, placing it in RapidRatings’ “medium-risk” category.

Similarly, Delta Air Lines Inc.’s

DAL,

FHR has tumbled from 87 at the end of 2019 to 25 at the end of the second quarter, putting it firmly in the “high-risk “category. Online travel site Booking Holdings Inc.

BKNG,

FHR has fallen to 53 from 86. Las Vegas Sands Corp.

LVS,

has fallen to 24 at the end of the second quarter from 86 at the end of 2019.

Source: RapidRatings

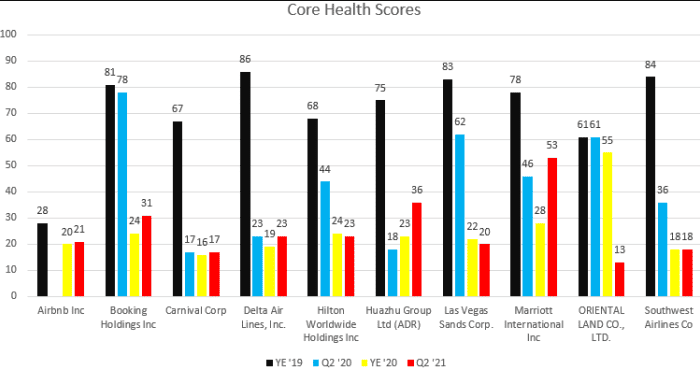

Core health scores have fared no better. Southwest’s has fallen to 18 from 84, putting in the “very poor” category, Delta’s from 86 to 23, the “poor” category, Booking’s from 81 to 31 and Las Vegas Sands to 20 from 83, all low scores that imply high risk over the medium to long term. Only Marriott International Inc.

MAR,

has been spared a poor core health score, falling to 53 from 78 at the end of 2019, to remain in RadpiRatings’ “medium” category.

Source: RapidRatings

“While the holiday season might give many of these companies a revenue boost, the hangover will be even more unpleasant come next year if the raw fundamentals don’t show signs of improvement beyond the next quarter,” said Gellert.

Cash is king

The deteriorating numbers come after companies in the public and private sectors were forced to borrow more, extend maturities and do whatever was needed to gain short-term liquidity at the height of lockdowns and restrictions on movement in 2020.

The airline sector, hammered when travel ground to a halt last spring, begged for a government bailout to boost liquidity, that came with onerous terms. Some airlines issued bonds backed by their own loyalty programs as grounded flights caused them to burn through cash.

The cruise sector was further hampered, when the Centers or Disease Control and Prevention mandated shutdowns for more than a year, and as companies fought with the state of Florida over their policies to require COVID-19 vaccinations for their crew and passengers.

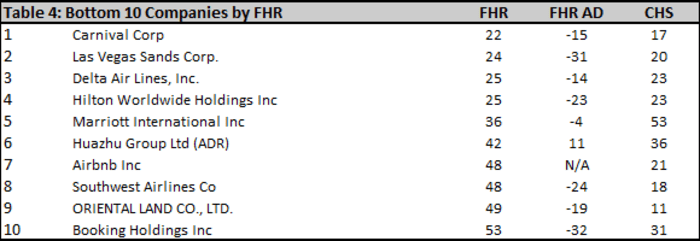

Carnival Corp.

CCL,

which had the lowest FHR score among the sample companies, has said that by the end of 2021, nearly 22 months after the COVID-19 breakout was declared a pandemic, it’s goal was to have 65% of its global cruise capacity operating.

Source: RapidRatings

At Booking.com, survival meant a host of actions from raising $4.1 billion in fresh debt, negotiating amendments to its revolving credit facility, restructuring activities, participating in government aid programs including wage support programs, suspending share buybacks and non-essential travel, reducing marketing spend and selling investments, according to its 2020 annual report, published in February.

“Cheap and easy access to capital provided an incredible Band-Aid to companies strong and weak,” said Gellert. “The big question is whether these companies can improve from pandemic trauma with this cash or whether it will run out prior to their return to health and when they need to pay the piper for the increased borrowing and future debt maturities that they may, or may not, be able to satisfy.”

Forgetting fundamentals

One factor that is making a difference is how much cash companies raised in 2020 that is now helping to see them through the current hardship. For example, Delta and Carnival both raised cash even as they added leverage, and that’s now giving them more resilience than Las Vegas Sands.

All three have suffered steep declines in revenue, decreasing profitability, or a swing to losses, and higher leverage. But Las Vegas Sands saw the biggest drop in FHR “in part because, contrasted with the others, the increase in debt was not accompanied by the resilience created from more liquidity. The other two have bought time with their cash,” said Gellert.

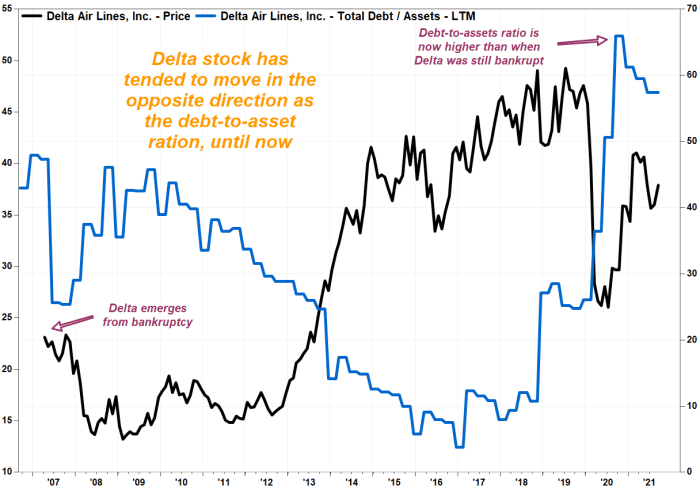

For investors, the market performance of many travel-related stocks looks highly disconnected from the RapidRatings data. Many have more than doubled from their pandemic lows, even as fundamentals show the companies are struggling.

Delta shares, for example, have rocketed about 125% off their post-pandemic closing low of $19.19 on May 15, 2020. Deutsche Bank analyst Michael Linenberg recently launched a “catalyst call buy” on the stock in anticipation of increased travel demand, saying Delta was one of the “highest quality names in the sector.”

See also: More than a quarter of Nasdaq-100 stocks are in bear markets — Wall Street sees a buying opportunity

But so far, investor confidence seems to be based on what they believe will happen, rather than what the reality of the air carrier’s quarterly results and balance sheet have shown.

Delta reported a return to a net profit in the second quarter of $652 million, the first since the pre-pandemic fourth quarter of 2019, but the profit resulted from the inclusion of $1.5 billion in benefits related to government payroll support programs. Excluding that benefit, Delta actually recorded an adjusted net loss of $678 million.

The total adjusted net loss for the first half of 2021 was $2.94 billion, not much better than the $3.14 billion loss suffered in the first half of 2020, while payments on debt and finance lease obligations during those periods have swelled more than 80% to $3.1 billion.

And yet the stock has more than doubled, even though the ratio of debt to assets has soared to the highest levels seen since before Delta last emerged from bankruptcy in April 2007. As the chart below shows, the stock price and the debt-to-asset ratio tend to move in opposite directions.

FactSet, MarketWatch

By

Ciara Linnane

and

Tomi Kilgore

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.