The rate of U.S. inflation reached a 40-year high of 8.6% in May as overall prices for things including rent, gas and food all remain on the rise.

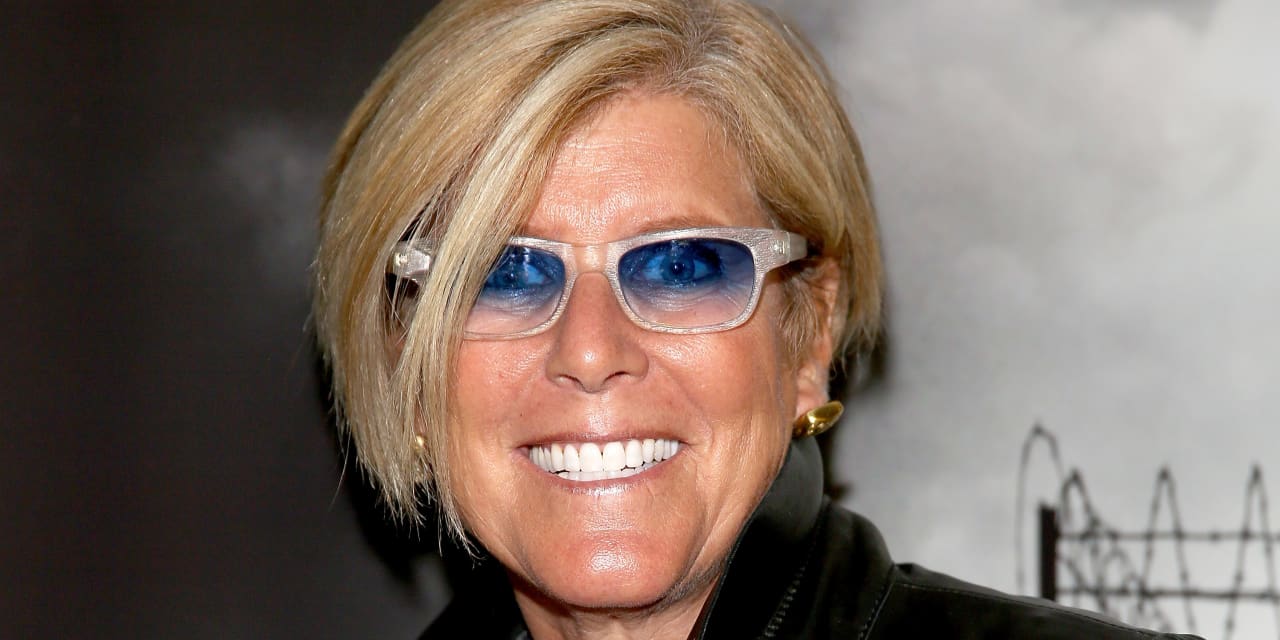

Financial commentator and host of the “Women & Money (And Everyone Smart Enough To Listen)” podcast Suze Orman said that she believes inflation may not be going away anytime soon.

“I personally believe that this inflation is here to stay for quite some time,”

Orman recently told CNBC, prior to the release of May’s CPI data from the U.S. Bureau of Labor Statistics.

See also: California is sending ‘inflation relief’ checks up to $1,050 — here’s who qualifies

And Orman says that she has an investment recommendation that may be smart to execute during times of high inflation.

“The No. 1 investment that every single one of you should have no matter what right now is a [U.S. Treasury] Series I bond.”

I-Bonds are U.S. savings bonds whose yields are adjusted by the prevailing inflation rate. I-Bond rates are the sum of two different rates. The first is a fixed rate when the purchaser buys the bond, and the second is the inflation adjustment rate, which is reset every six months based on inflation. You can find more information about I-Bonds here.

See also: Why is crypto crashing? Mark Cuban says ‘crypto is going through the lull that the internet went through’

People can invest between $25 and $10,000 in I-bonds, “so there’s no excuse that all of you should not have one,” Orman said.

You can only buy them from TreasuryDirect.gov, which notes that the initial interest rate on new Series I savings bonds is 9.62%. And you can buy I-Bonds at that rate through October 2022.

Also see: I-Bonds offer mouthwatering yields — but there are some arbitrage opportunities available to investors as well

Many Americans are fearful of current economic conditions, a University of Michigan report shows. Consumer sentiment in June dropped to a new low of 50.2, down from a May reading of 58.4

Americans’ expectations for inflation in the coming year increased to 5.4% in June from 3.3% in May, and expectations for inflation in the next five years increased to 3.3% from 3% in the previous month, according to the same report.

Also see: 1 in 3 Americans earning $250,000 or more say they live paycheck to paycheck — are they really?

On June 10, the Dow dropped as much as 750 points in early trading after higher-than-expected 8.6% inflation data was released — the S&P 500 Index

SPX,

-1.49%

and tech-heavy Nasdaq

COMP,

-0.23%

each also dropped over 2% the same day.