#Bond Report: Treasury yields move lower ahead of inflation data and Fed meeting this week

Table of Contents

“Bond Report: Treasury yields move lower ahead of inflation data and Fed meeting this week”

Bond yields fell on Monday as investors awaited crucial inflation data and the final Federal Reserve policy meeting of the year.

What’s happening

-

The yield on the 2-year Treasury

TMUBMUSD02Y,

4.323%

slipped 3.4 basis points to 4.327%. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

TMUBMUSD10Y,

3.528%

retreated 4 basis points to 3.544%. -

The yield on the 30-year Treasury

TMUBMUSD30Y,

3.501%

fell 5.1 basis points to 3.512%.

What’s driving markets

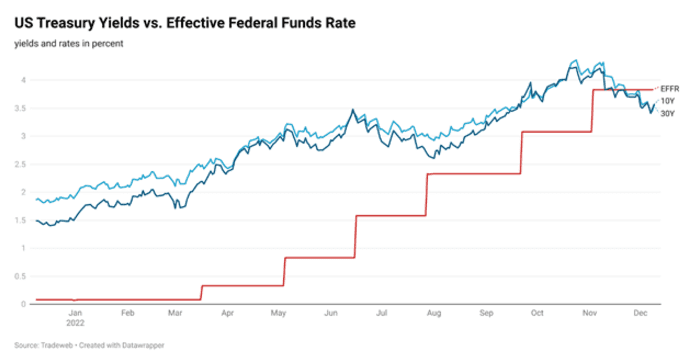

Benchmark 10-year yields nudged lower ahead of a crucial few days, with the U.S. consumer price index published on Tuesday and the Federal Reserve delivering its monetary policy decision on Wednesday.

Markets are pricing in a 74.7% probability that the Fed will raise interest rates by another 50 basis points to a range of 4.25% to 4.50% after its meeting on December 14th, according to the CME FedWatch tool. The last four rate hikes have been 75 basis points each.

The central bank is expected to take its Fed funds rate target to 4.95% by May 2023, according to 30-day Fed Funds futures, and only start easing very slightly by the end of that year.

Source: Tradeweb

Two other important central banks have policy meetings this week, too. The European Central Bank and Bank of England are both expected to raise rates by 50 basis points on Thursday, to 2.5% and 3.5% respectively. Benchmark 10-year German bund yields

TMBMKDE-10Y,

were down 1.8 basis points to 1.915% and equivalent duration gilts

TMBMKGB-10Y,

were off 5.2 basis points to 3.131%.

U.S. economic updates set for release on Monday include the New York Fed 1- and 5-year inflation expectations for November, due at 11 a.m.. The federal budget for November will be published at 2 p.m., all times Eastern.

What are analysts saying

“The fragility of recent rebounds was highlighted as fresh risk-off sentiment emerged ahead of an inflation print this week, followed by the latest Federal Reserve decision on interest rates. The two announcements are intertwined, with any prolonged heat on the inflation number providing the Fed with more ammunition to maintain its hawkish view,” said Richard Hunter, head of markets at Interactive Investor.

“While the expectation of a 0.5% rise in rates is now nailed on, of equal interest will be the accompanying comments on the Fed’s outlook, which could encompass not only the likely terminal rate but also an indication of how long rates may need to remain elevated. There is an increasing acceptance from investors that next year will see no interest rate reductions at all, with early 2024 being touted as the more likely outcome.”

“In the meantime, overtightening which could lead to a recession remains the key market concern. The inflation number due this week will drive sentiment, and data released on Friday which showed producer prices rising added to concerns that the inflationary beast may not yet have been tamed,” Hunter concluded.

By

Jamie Chisholm

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.