# Billionaires and philanthropy bigwigs want Congress to fix tax laws so charities can get more money faster

Table of Contents

“#

Billionaires and philanthropy bigwigs want Congress to fix tax laws so charities can get more money faster

”

The Ford Foundation and philanthropist Kat Taylor, the wife of former Democratic presidential candidate Tom Steyer, are among those who say they want to ‘accelerate charitable giving.’

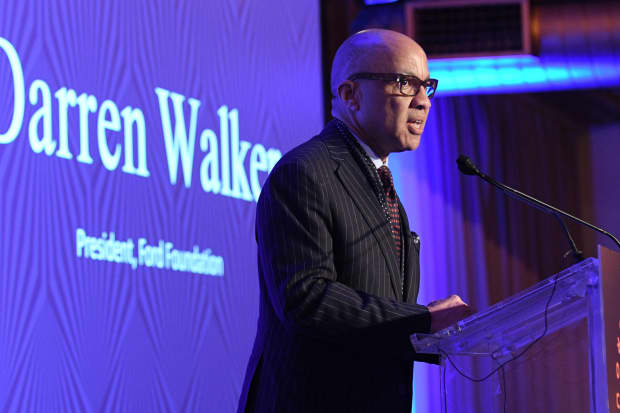

Ford Foundation Darren Walker is part of a new group seeking to reform tax laws around charitable giving. “Let’s increase funding to nonprofits now when it is needed most,” Walker said.

Photo by Gary Gershoff/Getty Images for Housing Works

Some of philanthropy’s heaviest hitters say they want Congress to reform tax laws so philanthropists can get money to those in need faster.

Several of the biggest foundations in the U.S. — including the Ford Foundation — announced on Giving Tuesday that they’ve formed a coalition devoted to “accelerating charitable giving” by reforming tax laws. The group also includes individuals such as former hedge-fund manager Michael Novogratz and Kat Taylor, founder of the TomKat Foundation and the wife of onetime Democratic presidential candidate Tom Steyer.

“The rules disincentivize philanthropists from giving with any sense of urgency,” said Arnold, a one-time trader at Enron. “Foundations and donor-advised funds get immediate tax breaks, and feel no pressure to deliver resources to where they are needed: charities solving this generation’s most pressing problems.”

To get more money into the hands of charities, the coalition, called The Initiative to Accelerate Charitable Giving, is proposing changing tax rules around three ways that philanthropic dollars get distributed: private foundations, donor-advised funds and individual donations.

They say these reforms would help unleash more than $1 trillion that’s sitting in private foundations and donor-advised funds.

“As a proud member of @AccelGiving, I hope foundation leaders will join in supporting charitable giving reforms,” Ford Foundation president Darren Walker said on Twitter

TWTR,

“Let’s increase funding to nonprofits now when it is needed most.”

Here’s what the coalition is proposing:

Closing loopholes that let private foundations make questionable expenditures

Under current tax laws, private foundations must pay out 5% of their assets per year, theoretically by making grants to nonprofits. But there are ways around that rule, the coalition notes on its website, and it seeks to close some of those loopholes.

Under the coalition’s proposals, a foundation would no longer be allowed to count salaries or travel expenses for the family members who started the foundation as part of its annual 5% payout. Private foundations also wouldn’t be allowed to meet their payout obligations by putting money into donor-advised funds (controversial charitable-giving vehicles; more on that below).

“

‘If you’re wondering about the disparity between the immense philanthropic wealth in this country and the daily fight most charities have to wage to stay alive, look no further than charitable tax laws.’

”

— John Arnold, founder and co-chair of the philanthropic LLC Arnold Ventures

The coalition isn’t seeking to increase foundations’ required payout to more than 5%. But it says it wants to do other things that would incentivize foundations to increase their payouts. One step would be to eliminate the excise tax foundations have to pay on their investment income if a foundation increases its payout to 7% or more.

The coalition is also suggesting scrapping the excise tax altogether for newly formed foundations that put a deadline of 25 years or less on their operations. Putting a time limit on a foundation is an alternative to the traditional style of operating a foundation in perpetuity. It’s becoming increasingly popular.

Putting deadlines on donor-advised funds

Donor-advised funds are vehicles for charitable giving that have been in critics’ crosshairs for several years. DAFs are popular with Silicon Valley billionaires and others with extra cash or stock. Typically, wealthy donors use a DAF account to set aside money for charity. The donors get a tax deduction when they put money into the DAF. But there’s no deadline for when that money has to leave the DAF and make its way to a charity.

Critics have said this system amounts to “warehousing wealth,” giving the 1% a tax break while doing little to help frontline nonprofits. The Initiative to Accelerate Charitable Giving wants Congress to create a new form of DAFs that would only give donors a tax break if they move money out of the DAF within 15 years.

That may sound like a long time to some, but coalition member Ray Madoff, a Boston College law professor and expert on philanthropy, says the 15-year limit strikes a balance that accommodates many types of donors.

“Some donors use [DAFs] to fund annual giving, and for those donors, a shorter time period might make sense,” Madoff told MarketWatch in an email. “However, we know that other donors — for example, those whose company is about to go public — may transfer millions or even hundreds of millions of dollars into a DAF, and those donors may need more time to decide about their charitable giving.”

“The 15-year limit would accommodate both of those types of donors while still recognizing the societal need for funds to flow to charities within a reasonable period of time,” she added.

Expanding tax deductions for individual donors

Traditionally, people donating to charity only get a tax deduction if they itemize the expense when they file their taxes. This year, under the CARES Act, Americans are allowed to claim a tax deduction on up to $300 in charitable contributions without itemizing. The Initiative to Accelerate Charitable Giving wants Congress to consider expanding and extending that deduction.

The chances for success in Congress

The coalition is optimistic that its effort will garner bipartisan support, Madoff said. “Legislators across the political spectrum recognize the importance of the charitable sector and the need to increase the flow of dollars so that they can perform their essential functions that make all of our lives better,” she said.

Others wants more drastic reforms for philanthropy

The Initiative to Accelerate Charitable Giving shares similar themes with a separate set of reforms pitched by another group of wealthy philanthropists earlier this year. Disney

DIS,

heiress Abigail Disney and other members of the Patriotic Millionaires, a group that advocates for higher taxes on the wealthy, have been lobbying for an “emergency charity stimulus bill” that would require private foundations to double their payout rate to 10% for the next three years.

The bill would also require DAFs to send 10% of their assets to nonprofits every year. Chuck Collins — an heir to the Oscar Mayer fortune and one of the backers of the emergency charity stimulus — said he agrees with the coalition that there’s a need to change tax rules governing philanthropy.

But he wants more drastic reforms than the ones the Initiative to Accelerate Charitable Giving is proposing.

“At a time that cries out for bold reforms to fix philanthropy and protect the taxpayers, this proposal is incremental and wimpy,” Collins told MarketWatch. “We need Congress not to tweak a broken set of rules, but do a better job protecting the public’s interest from those who use private foundations and donor-advised funds.”

By

Leslie Albrecht

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.