# A new COVID-19 strain is sending stocks plunging, but here’s why investors shouldn’t panic, says this analyst

Table of Contents

“#

A new COVID-19 strain is sending stocks plunging, but here’s why investors shouldn’t panic, says this analyst

”

Critical information for the U.S. trading day

A new $900 billion coronavirus stimulus deal has finally been struck — but U.S. stocks are falling.

Fears over a new strain of the coronavirus that causes COVID-19, discovered in the U.K., have spooked investors at the beginning of Christmas week. The U.K.’s health minister Matt Hancock warned that the new strain, said to be highly infectious, was “out of control” as the government scrapped a planned relaxation of the rules over the holiday period. Prime Minister Boris Johnson said the strain could be 70% more transmittable.

The developments have brought a return to uncertainty, hitting global stocks early on Monday. Despite the COVID-19 aid deal, the Dow Jones Industrial Average

DJIA,

fell 0.9%, or 265 points, in early trading, while the pan-European Stoxx 600

SXXP,

was 2.7% lower.

In our call of the day, Markets.com analyst Neil Wilson described the market move as near-term volatility and said “corrections of this nature” are to be expected on the road to full vaccine deployment.

“This is the kind of near-term volatility we can expect until the full force of vaccines is felt. There has been a lot of hope already priced in with the vaccine-inspired November rally so we cannot expect a straight line higher for stocks,” he said in a note on Monday.

He added that the rotation trade was unwinding, at least in the U.K., due to tighter measures and travel restrictions, with oil companies BP

BP,

and Royal Dutch Shell

RDSB,

and British Airways owner IAG

IAG,

among the notable fallers, and online grocer Ocado

OCDO,

and food-delivery company Just Eat Takeaway

JET,

among the few European stocks rising.

With the full impact of the vaccine some months away, Wilson warned investors to be prepared for a rough ride. “The cavalry may be coming but the homesteaders need to batten down the hatches and face another onslaught before they arrive,” he said.

The markets

After closing 0.4%, or 124.32 points, lower on Friday, the Dow Jones Industrial Average

DJIA,

was 0.9% lower in early trading despite the new coronavirus stimulus deal. The S&P 500

SPX,

fell 1.6% and the Nasdaq Composite

COMP,

slipped 1.5%. The discovery of a new strain of coronavirus in the U.K. was to blame for the negativity, with European stocks hit hardest. The German DAX

DAX,

fell 3% and the French CAC

PX1,

dropped 2.8%.

The pound

GBPUSD,

tumbled 1.6% as a result of countries banning travel to the U.K. amid the new virus strain and a lack of progress in the Brexit trade deal talks. Sterling’s weakness mitigated losses for the internationally-exposed FTSE 100

UKX,

which was 1.8% lower. Oil prices

CL00,

BRN00,

fell sharply on concerns the new strain will hit demand.

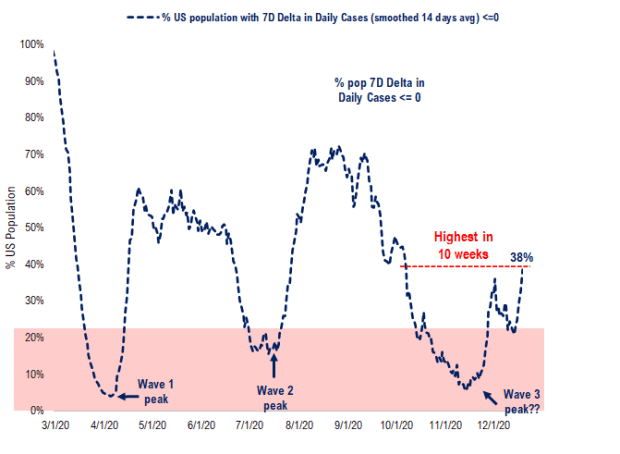

The chart

Source: Johns Hopkins and Fundstrat

Our chart of the day from Fundstrat shows that the percentage of the U.S. with falling cases is at 38% — the highest level since early October, which its analysts said may suggest the third wave has peaked. But they added that the situation in California was “pretty serious.”

The buzz

Biotech Moderna

MRNA,

began distributing its COVID-19 vaccine on Sunday, the second vaccine to be authorized in the U.S.

The European Union authorized its first vaccine against COVID-19 on Monday, joining the U.K. and the U.S. in approving the Pfizer

PFE,

and BioNTech

BNTX,

jab.

A suggestive tweet by Tesla Chief Executive Elon Musk has led to a discussion about a potential ‘$1-trillion favor’ for Tesla shareholders.

Tesla

TSLA,

stock debuted as an S&P 500 index component with a thud, as it opened 4.1% lower, before extending losses.

Anglo-Dutch oil major Royal Dutch Shell

RDSB,

said it expects to book charges of between $3.5 billion and $4.5 billion in the fourth quarter due to write-downs, asset restructuring and onerous contracts. The stock fell 3.7% in early trading.

Pharmaceutical company GlaxoSmithKline

GSK,

said on Monday that the European Union has granted market authorization for ViiV Healthcare’s long-acting HIV treatment Vocabria.

New York Governor Andrew Cuomo called it “reprehensible” and “grossly negligent” to allow U.K. travelers to fly into JFK Airport without being tested despite a contagious new mutations of coronavirus shutting down London.

Random reads

Couple holds ‘10,000 guest’ drive-thru wedding.

A giant computer-generated version of singer Rita Ora will arrest anyone trying to leave London, a viral Twitter

TWTR,

joke warns.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead: Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

By

Callum Keown

If you liked the article, do not forget to share it with your friends. Follow us on Google News too, click on the star and choose us from your favorites.

For forums sites go to Forum.BuradaBiliyorum.Com

If you want to read more News articles, you can visit our News category.